TL;DR: Why CEE Unicorns Bootstrap at 4X the Rate of Western Europe

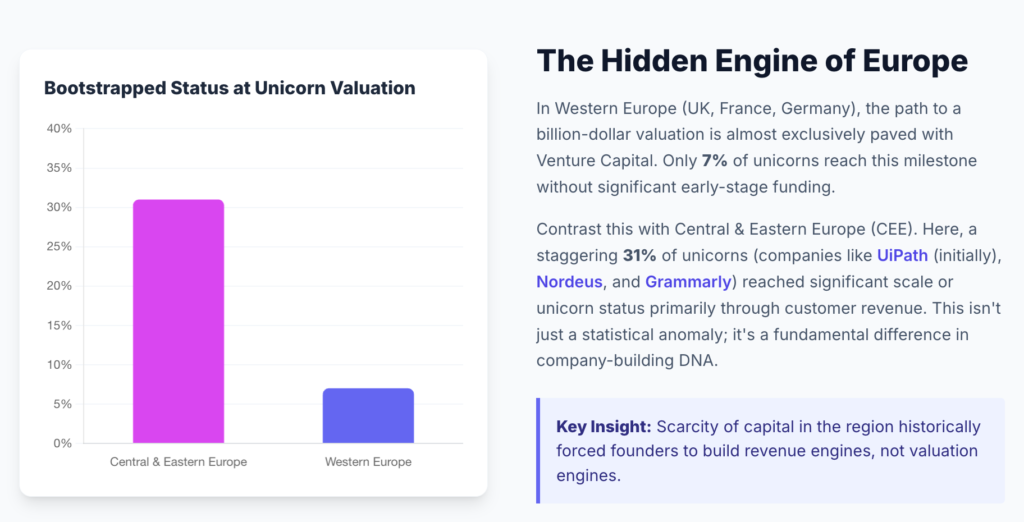

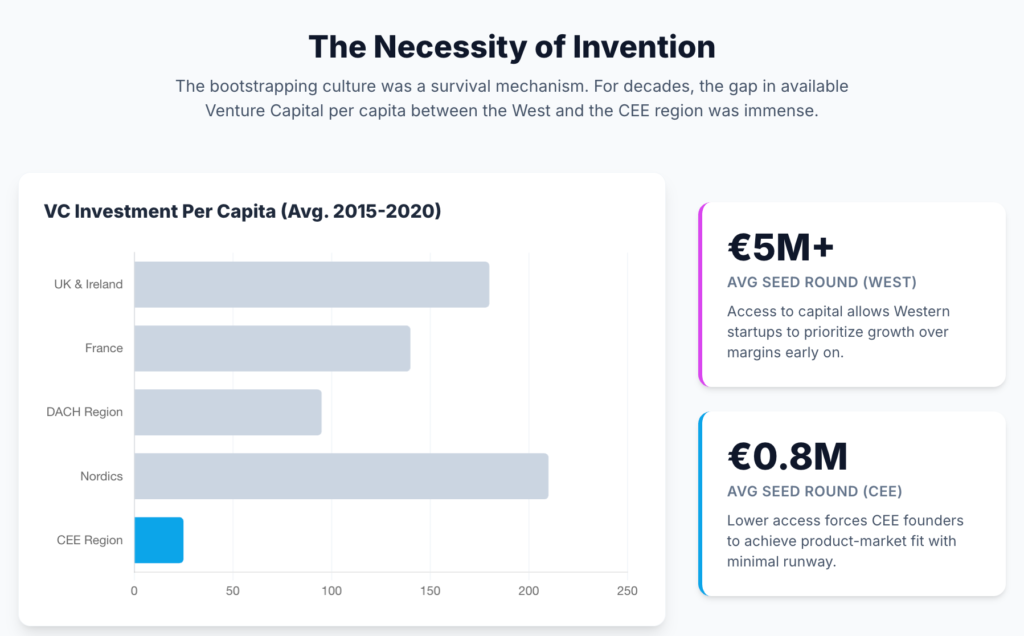

Central and Eastern Europe (CEE) produces 31% of unicorns through bootstrapping, compared to only 7% in Western Europe. This phenomenon is driven by capital scarcity, efficient scaling methods, and a “default alive” mindset.

• CEE unicorns require smaller funding rounds, Series B rounds are 56% smaller than Western averages.

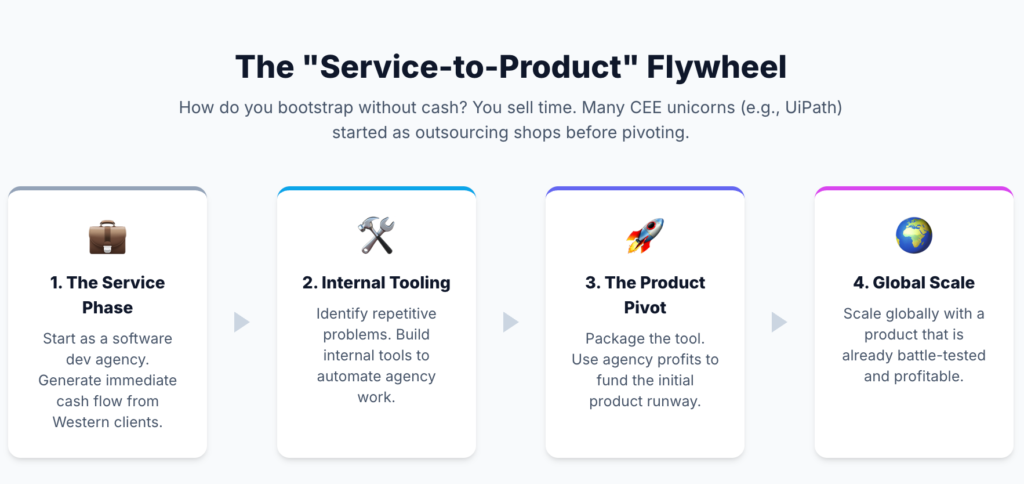

• Founders leverage “Software from a Service” models, transitioning service revenue into scalable software products.

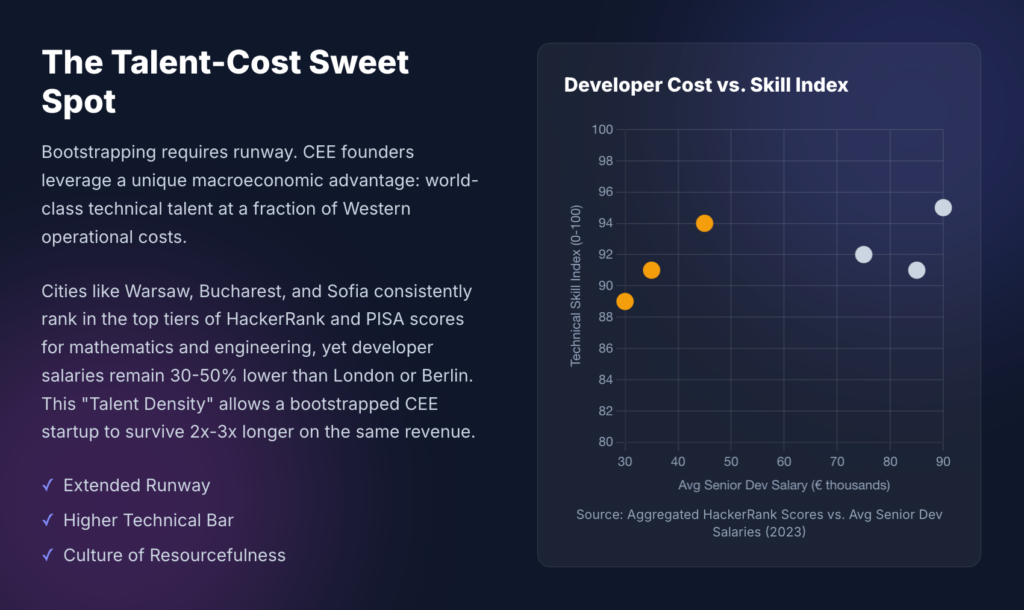

• Talent costs in CEE are 30-50% lower, allowing startups to scale with higher technical density.

• Despite early-stage efficiency, CEE struggles with late-stage funding, prompting 48% of scaleups to move HQs abroad.

Will this lean startup model reshape global tech in the face of rising capital costs? Read what I discovered when doing this research.

The European technology sector has historically been viewed through the lens of a “capital gap” relative to Silicon Valley.

Yet, within the continent, a profound internal divergence has emerged that challenges the conventional wisdom of venture-backed growth. This structural anomaly, often referred to as the “31% Phenomenon,” highlights a stark contrast in entrepreneurial methodology: while only 7% of unicorns in Western Europe reach billion-dollar valuations through bootstrapping, nearly one-third, 31%, of unicorns originating from Central and Eastern Europe (CEE) achieve the same milestone without significant early-stage external capital.

This divergence is more than a statistical curiosity; it represents a fundamentally different architectural approach to company building, characterized by extreme capital efficiency, technical density, and a “default alive” survivalist ethos born from historical necessity.

As of the first quarter of 2025, the CEE region has produced 56 unicorns, contributing approximately 9% of Europe’s total count of 601 billion-dollar companies.

However, the efficiency with which these valuations are created remains the region’s primary competitive advantage.

Between 2015 and 2025, the total enterprise value of the CEE startup ecosystem surged by 15.5x, reaching €243 billion; a growth rate that is more than double the European average of 7x during the same period.

I took a deep dive and my analysis explores the socio-economic, technical, and financial drivers of this phenomenon, contrasting the “Capital Efficiency 2.0” model of the CEE with the capital-intensive “blitzscaling” typical of Western European hubs.

The Macro-Economic Landscape: Ecosystem Maturity and Resilience

The emergence of the CEE as a global tech powerhouse is a phenomenon decades in the making. In 2012, the regional ecosystem was valued at a modest €18 billion.

By 2023, that figure reached €213 billion, representing a 2.4x growth since 2019 alone, despite a global contraction in venture activity.

This trajectory underscores a shift from a region known primarily for outsourced IT services to one that creates high-value proprietary products.

Comparative Ecosystem Value and Growth Rates (2015-2025)

| Metric | Central and Eastern Europe (CEE) | Western Europe (Average) | CEE Multiplier |

| Total Enterprise Value (2025) | €243 Billion | N/A | N/A |

| Ecosystem Value Growth (2015-2025) | 15.5x | 7x | 2.2x |

| Percentage of Bootstrapped Unicorns | 31% | 7% | 4.4x |

| Funding Contraction in 2023 | -15% | -35% | 2.3x (Higher Resilience) |

| Share of Global New Unicorns | ~9% (of Europe) | ~70% (of Europe) | N/A |

The resilience of the CEE region became particularly evident during the 2023 venture downturn. While investment in Western Europe plunged by 35% as high-interest rates cooled the market for growth-stage capital, funding in the CEE contracted by only 15%. This resilience is partly due to the region’s focus on early-stage deals (92% of all VC-backed deals in CEE occur at the pre-seed and seed stages) but it is also a function of the pragmatic founder mindset that characterizes the region.

The Mechanics of Capital Efficiency: Round Sizes and Valuations

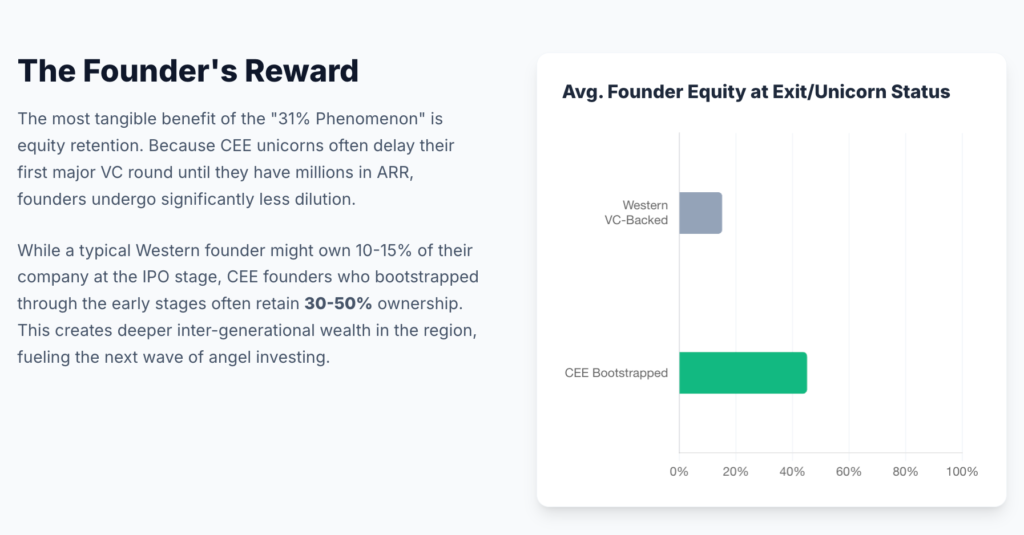

The “Capital Efficiency 2.0” model is best quantified through the median funding required to reach specific milestones. CEE startups consistently reach unicorn status with significantly smaller funding rounds than their Western European counterparts. This lean financing model is a byproduct of both historical capital scarcity and a cultural preference for maintaining founder control through higher equity retention.

Median Funding Round Sizes: CEE vs. Western Europe

| Funding Stage | CEE Median Round | European Average Round | Efficiency Gap (%) |

| Series A | €8.5 Million | €9.6 Million | 11.5% |

| Series B | €10.0 Million | €22.7 Million | 55.9% |

| Series C+ | €31.0 Million | €36.4 Million | 14.8% |

The most dramatic efficiency is found at the Series B stage. CEE companies typically raise less than half the capital of their Western peers during this mid-growth phase. This suggests that by the time a CEE company reaches Series B, it has likely already established robust revenue streams, reducing its dependency on external cash for operational survival. The Valuation-to-Capital ratio is consequently higher in the CEE, meaning more enterprise value is created for every euro invested compared to the broader European average.

The Burn Multiple and Cumulative Productivity

A critical metric in this analysis is the “Burn Multiple,” a concept used to measure the efficiency of capital deployment. It is mathematically defined as:

Burn Multiple = Net Burn / Net New ARR

Lower multiples indicate higher efficiency. While a multiple of 1.5x is considered “excellent” for early-stage SaaS globally, many CEE unicorns operate at or below 1.0x, effectively using revenue from existing customers to fund the acquisition of new ones. This allows these companies to stay “default alive”; a state where their current cash reserves and revenue trajectory ensure survival without the need for further external funding.

The “Software from a Service” (SfaS) Evolution

The high rate of bootstrapping in CEE is intrinsically linked to the region’s history as a hub for software development outsourcing. Many of the region’s most successful companies did not start with a pitch deck but with a service contract. This model, termed “Software from a Service” (SfaS), involves building a proprietary product on the foundations of a profitable service business.

In this framework, founders are “paid to learn.” They identify specific, recurring pain points while providing custom solutions for clients. Once a solution is generalized, it is converted into a scalable software product. This strategy allows founders to skip the high-risk “search for product-market fit” that consumes millions in venture capital in the West. By the time an SfaS company raises a Series A, it often already possesses multi-million dollar revenue and a deep understanding of its target market’s business needs.

The 80/20 Rule of Automation

Successful SfaS transitions in CEE often follow a specific value proposition: automating a manual service to provide 80% of the manual value at approximately 20% of the cost. For example, Infobip, Croatia’s first unicorn, bootstrapped from its inception in 2006 for 14 years, reaching $1 billion in revenue without external investment. By the time they accepted private equity in 2020, they had already built a global communications platform used by the likes of Uber and 750+ mobile operators.

Talent Arbitrage and the Cost of Engineering

The foundational advantage of the CEE ecosystem is the significant disparity in employment costs between Eastern and Western Europe. Despite the convergence of tech salaries globally, hiring a mid-level software developer in Warsaw or Bucharest remains 30% to 50% cheaper than in London or Berlin.

Annual Software Engineer Costs and Savings Potential (2025)

| City | Average Annual Salary (Gross) | Total Employment Cost | Savings Potential (High-End) |

| London | €70,225 | €80,146 | €37,802 |

| Berlin | €73,730 | €91,824 | N/A |

| Paris | €56,994 | €90,690 | N/A |

| Zurich | €110,000+ | €120,000+ | €39,604 |

| Warsaw | €53,000 | €62,000* | €32,770 |

| Bucharest | €50,000 | €58,000* | €32,838 |

| Belgrade | €48,000 | €54,000* | €21,833 |

*Estimated based on regional tax and social contribution data.

The cost-to-net-pay ratio in Western Europe is often higher due to aggressive social security and tax structures. In Paris, an employer’s total cost for a developer can be 2.36x the employee’s net pay, whereas in London or Warsaw, this ratio is closer to 1.5x. This means a CEE-based startup can deploy the same amount of capital to hire 1.5x to 2x more engineers than a competitor in Paris or Berlin, dramatically accelerating product development while maintaining the same burn rate.

The Productivity Paradox: Revenue per Employee

A higher concentration of technical talent relative to non-technical staff further enhances the region’s efficiency. Research indicates that the median revenue per employee for private SaaS companies has jumped to $129,000-$173,000 as AI and automation slash headcount requirements. CEE startups, which traditionally maintain leaner sales and marketing teams, are particularly well-positioned to benefit from this trend. In contrast, many Western European unicorns invested heavily in massive sales organizations during the 2020-2021 boom, leading to lower productivity per employee during the subsequent market correction.

Cultural Determinants: The Underdog Mentality and “Born Global” Strategy

The “31% Phenomenon” is also driven by cultural and domestic market constraints. Because domestic markets in countries like Estonia (1.3 million people) or Lithuania (2.8 million people) are too small to support a billion-dollar company, founders are forced to adopt a “Born Global” mindset from day one.

The Born Global Mindset

In larger Western European markets, startups often spend their first three to five years focusing on their home market (France, Germany, or the UK) before attempting international expansion. CEE startups, conversely, must design their products for international users immediately. This removes a significant “pivot risk” that many Western companies face when they realize their domestic product-market fit does not translate globally.

The “Default Alive” Mindset

Founder-market fit in the CEE often involves what investors call a “chip on the shoulder” or an “underdog mentality”. Many founders in the region grew up during the economic transitions of the 1990s and early 2000s, instilling a deep sense of fiscal discipline and a preference for profitability over external validation. This culture views a funding round not as a success in itself, but as a liability to be managed, leading to the high rates of bootstrapping observed.

Survival Metrics: The Funding Winter and the Scaleup Gap

While CEE startups are more efficient, they are not immune to the “Scaleup Funding Gap.” Although the region produces a high volume of early-stage companies, the graduation rate from Seed to Series A in CEE is 29%, significantly lower than the European average of 48% and the global average of 53%.

The Funding Funnel: CEE vs. Global Benchmarks

| Metric | CEE Ecosystem | US Ecosystem | Europe (Average) |

| Scaleups as % of VC-backed firms | 7.2% | 32.0% | N/A |

| Graduation Rate (Seed to Series A) | 29.0% | 53.0% | 48.0% |

| Dependence on Public Capital | ~34% | Low | Moderate |

| Total Scaleup Count (2025) | 275 | 18,000 | N/A |

This gap creates a paradox: CEE startups are “better” at reaching profitability with less capital, but they struggle to access the “mega-rounds” ($100 million+) required to dominate global markets. Consequently, 48% of CEE scaleups eventually move their headquarters outside the region (primarily to the United States (56%) or the UK) to access deeper capital markets, even while keeping their core R&D operations in their home countries.

Case Studies: Titans of the CEE Bootstrapping Model

Infobip (Croatia)

Infobip’s journey is perhaps the most iconic example of the regional model. Founded in 2006, the company operated for 14 years without external capital, reaching $1 billion in revenue through organic growth. The founders, Silvio and Roberto Kutić, maintained a “humble engineer” philosophy, focusing on technical robustness and global reach. Today, the company processes over 350 billion transactions annually, connecting 7 billion mobile devices.

Grammarly (Ukraine)

Founded in Kyiv in 2009, Grammarly bootstrapped for eight years before raising its first institutional round of $110 million in 2017. The founders used a “freemium flywheel” model, where a superior product generated massive organic traffic, reducing the need for the expensive paid marketing that plagues many Western consumer startups. By 2021, the company reached a $13 billion valuation with 30 million daily users.

JetBrains (Czechia)

A leader in developer tools, JetBrains is a rare “perpetual bootstrapper.” The company has reached a multi-billion dollar valuation primarily through revenue from its popular IDEs like IntelliJ IDEA and the Kotlin programming language. Its success is built on an intimate understanding of the developer experience, a hallmark of the CEE ecosystem’s technical depth.

The “Flywheel” Effect: Reinvestment and Alumni Founders

The 31% phenomenon is now fueling a compounding “flywheel” effect in the region. As early unicorns mature, their employees, armed with both capital from exits and scaling experience, are founding the next generation of startups. Over 300 former employees of regional leaders like Skype, Wise, Bolt, and Allegro have gone on to found new ventures.

Unicorn Alumni Spinouts: Leading Contributors

| Origin Unicorn | Notable Spinout Industries | Home Country |

| Skype | Fintech, Mobility, Deeptech | Estonia |

| Bolt | Logistics, Foodtech, AI | Estonia |

| Wise | Neobanks, Payments, Compliance | Estonia |

| Allegro | E-commerce Infrastructure, SaaS | Poland |

| Rimac | EV Components, Energy | Croatia |

| Pipedrive | Sales CRM, Productivity | Estonia |

Estonia leads this trend; with 14 unicorns for just 1.3 million people, it has the highest unicorn density in the world. The “Skype Mafia” alone has been credited with providing the initial seed capital and mentorship for nearly half of the country’s subsequent unicorn successes.

Sectoral Specialization: Where CEE Dominates

The CEE’s capital efficiency is most pronounced in sectors where technical complexity acts as a moat, reducing the need for aggressive marketing spend.

- Enterprise SaaS: Companies like Creatio (Ukraine) and Productboard (Czechia) compete globally by offering deeper customization and lower TCO (Total Cost of Ownership) than Western competitors.

- Cybersecurity: Building on a long tradition of mathematical excellence, firms like Avast (Czechia) and various Ukrainian-led security firms dominate global market shares with minimal external funding in their early years.

- AI and Data Platforms: ElevenLabs (Poland) reached a $6.6 billion valuation through a combination of elite technical talent and global viral adoption, raising capital only once the product had already established technical dominance.

- Mobility and Deeptech: Rimac Automobili (Croatia) and Skeleton Technologies (Estonia) demonstrate that even capital-intensive hardware can be grown efficiently in the CEE by focusing on high-margin B2B partnerships (e.g., Rimac supplying components to Porsche) rather than direct-to-consumer blitzscaling.

Geographic Hubs: A Distributed Network of Success

Unlike Western Europe, where unicorn activity is heavily concentrated in London, Paris, and Berlin, the CEE billion-dollar companies are spread across a network of national hubs. This “distributed model” acts as a hedge against localized economic downturns.

- Poland (€58B Ecosystem Value): The regional leader in absolute terms, hosting 18 unicorns and the largest scaleup pipeline.

- Estonia (€39B Ecosystem Value): The efficiency champion, leading in unicorns per capita and breakout-stage funding.

- Ukraine (€30B Ecosystem Value): Demonstrates extreme resilience; despite conflict, the tech sector continues to grow, producing nine unicorns and a robust GovTech/DefenseTech scene.

- Czechia (€28B Ecosystem Value): A leader in late-stage funding, with companies like Rohlik and Mews securing significant growth capital.

- Lithuania (€16B Ecosystem Value): The fastest-growing ecosystem since 2020, expanding nearly sixfold in five years.

Comparative Analysis with Western European Strategy

The 7% bootstrapping rate in Western Europe reflects a strategy optimized for “Land and Expand” in high-CAC environments. In markets like London or Berlin, the primary challenge is not building the product, but being heard over the noise of competitors. This requires massive investments in Sales & Marketing (S&M), often representing 40-60% of total OPEX for a Western SaaS company.

In contrast, a CEE startup’s OPEX is typically skewed toward Engineering (R&D). This allows them to build products that “sell themselves” through PLG (Product-Led Growth) strategies, which are 2x more efficient in terms of customer acquisition than traditional sales-led models. Furthermore, the lack of local growth-stage VCs in CEE (only 4% of European late-stage deals occur in the region) has historically made bootstrapping a necessity rather than just a choice.

The Impact of Interest Rates and the 2025 Rebound

As of Q1 2025, the global venture market has been recovering, with total investment staying above the $90 billion mark for four consecutive quarters. However, the “new normal” of higher capital costs is forcing Western European founders to look toward the CEE for lessons in efficiency. The “Rule of 40” (where Growth % + Profit % should be > 40%) has replaced pure growth as the primary valuation driver, giving an edge to the naturally efficient CEE models.

Future Outlook: The Convergence of East and West

Toward 2026, several trends suggest the CEE region will continue to outpace Western Europe in efficiency metrics:

- AI-Native Workflow Adoption: CEE startups are among the fastest to adopt AI-native engineering workflows, further reducing their cost of development.

- Defense and Deeptech: The NATO Innovation Fund and increased regional security concerns are driving a surge in DefenseTech, a sector where the CEE’s technical depth and cost-efficiency are critical for rapid prototyping.

- The Closing Salary Gap: While CEE salaries are rising, the cost-of-living advantage remains significant. Remote-first arbitrage, where developers live in CEE but work for global markets, will continue to fuel local reinvestment.

- Institutional Maturity: The emergence of homegrown growth funds and increased interest from US giants (like Andreessen Horowitz and Sequoia) in the region suggests that the “Scaleup Gap” may finally begin to close.

Conclusions: The Efficiency Blueprint

The “31% Phenomenon” is not merely a regional success story; to me it’s more of a fundamental critique of the capital-intensive startup models that dominated the last decade. The data suggests that CEE unicorns have mastered a superior form of company building, one that prioritizes:

- Engineering over Arbitrage: Building moats through technical complexity rather than through aggressive marketing spending.

- Customer-Funded R&D: Leveraging the SfaS model to ensure product-market fit before taking on dilutive capital.

- Pragmatic Globalism: Designing for international markets from day one to mitigate domestic ceiling risks.

- Frugal Resilience: Maintaining a “default alive” status to survive macro-economic cycles that cripple capital-dependent peers.

For investors, the CEE represents an asymmetric opportunity: a region with higher GDP growth prospects than Western Europe, lower labor costs, and a demonstrated ability to create world-class technology with a fraction of the capital. For founders everywhere, the 31% Phenomenon offers a blueprint for building resilient, sustainable, and ultimately more valuable enterprises in an era of expensive capital.

People Also Ask:

What are the European unicorns this year?

In 2026, 27 European startups, including companies from the United Kingdom, Germany, and Sweden, achieved a $1 billion valuation. Examples include Tide, Fuse Energy, and Quantum Systems.

What is the 50/100/500 rule startup?

The 50/100/500 rule signifies a company’s transition from startup status to a mature business upon reaching $50M in revenue, 100 employees, or a $500M valuation.

What happens when a startup reaches a valuation of $1B?

A privately held startup with a $1 billion valuation is termed a “unicorn.”

Why are CEE unicorns bootstrapped at higher rates than Western European startups?

CEE startups bootstrap more frequently due to limited access to venture capital, fostering innovation with fewer external resources.

Which countries are leading in European unicorn creation?

The United Kingdom, Germany, and Sweden are principal contributors to European unicorn creation.

What makes the CEE region unique in startup growth?

The CEE region boasts a robust entrepreneurial culture, technical expertise, and cost-efficient markets, driving startup growth.

How does bootstrapping benefit startups?

Bootstrapping allows founders to maintain control, focus on sustainable growth, and minimize dependency on external funding.

What factors impact the success of CEE unicorns?

Key factors include strong technical talent, local market adaptability, and a global mindset in scaling businesses.

How is valuation calculated for unicorn startups?

Valuation for unicorns is typically determined by projecting revenue growth, analyzing investor funding, and comparing market benchmarks.

How does bootstrapping influence startup culture?

Bootstrapped startups prioritize resourcefulness, creativity, and frugality, which create resilient and innovative company cultures.

About the Author

Violetta Bonenkamp, also known as MeanCEO, is an experienced startup founder with an impressive educational background including an MBA and four other higher education degrees. She has over 20 years of work experience across multiple countries, including 5 years as a solopreneur and serial entrepreneur. Throughout her startup experience she has applied for multiple startup grants at the EU level, in the Netherlands and Malta, and her startups received quite a few of those. She’s been living, studying and working in many countries around the globe and her extensive multicultural experience has influenced her immensely.

Violetta is a true multiple specialist who has built expertise in Linguistics, Education, Business Management, Blockchain, Entrepreneurship, Intellectual Property, Game Design, AI, SEO, Digital Marketing, cyber security and zero code automations. Her extensive educational journey includes a Master of Arts in Linguistics and Education, an Advanced Master in Linguistics from Belgium (2006-2007), an MBA from Blekinge Institute of Technology in Sweden (2006-2008), and an Erasmus Mundus joint program European Master of Higher Education from universities in Norway, Finland, and Portugal (2009).

She is the founder of Fe/male Switch, a startup game that encourages women to enter STEM fields, and also leads CADChain, and multiple other projects like the Directory of 1,000 Startup Cities with a proprietary MeanCEO Index that ranks cities for female entrepreneurs. Violetta created the “gamepreneurship” methodology, which forms the scientific basis of her startup game. She also builds a lot of SEO tools for startups. Her achievements include being named one of the top 100 women in Europe by EU Startups in 2022 and being nominated for Impact Person of the year at the Dutch Blockchain Week. She is an author with Sifted and a speaker at different Universities. Recently she published a book on Startup Idea Validation the right way: from zero to first customers and beyond, launched a Directory of 1,500+ websites for startups to list themselves in order to gain traction and build backlinks and is building MELA AI to help local restaurants in Malta get more visibility online.

For the past several years Violetta has been living between the Netherlands and Malta, while also regularly traveling to different destinations around the globe, usually due to her entrepreneurial activities. This has led her to start writing about different locations and amenities from the point of view of an entrepreneur. Here’s her recent article about the best hotels in Italy to work from.